What Best Describes the Time Value of Money

The amount to which some current sum of money willgrow over time. The difference in the worth of a sum today and in the future.

Division Grade 4 Word Problem Worksheets Kindergarten Worksheets Sight Words 4th Grade Math Worksheets

The relationship between time and money.

. Accounts receivable that will be collected at a later date. The relationship between time and money. What does this refer to.

Which of the following situations does NOT base an accounting measure on present. Which statement best describes the concept of the time value of money. The monetary increase found in earning interest Advertisement.

Select the correct answer. Payment for the use of money. C The fact that invested cash may not earn interest over time is called the time value of money.

The value of money does not change over time D. The time value of money implies that. A series of payments to be received at a common interval during a period of time.

A dollar in the future. An investment in a checking account. The interest rate charged on a loan.

The relationship between time and money. Which of the following best describes the structure of an annuity. 1- What best describes the time value of money.

The Par Value of a bond is like an annuity. The time value of money refers to the fact that a peso received today is worth more than a peso promised at some time in the future. Asked Sep 24 2015 in Business by Asiah.

Gradual growth of your debt due to excessive use of credit C. The time spent with loved ones OC. A decrease in the amount of interest earned over a given period.

The interest rate charged on a loan. A series of payments to be received during a period of time. Which of the following best describes these common characteristics.

OA the income one gets from a part-time job OB. Solved 1 What Best Describes The Time Value Of Money A Chegg Com Solved Which Of The Following Best Describes An Annuity Oa Lump Sum Is Deposited Into An Account Earning Simple Interest Oa Lump Sum Is Deposited Into An Account Earning Compound Interest Deposits Are Share. D A dollar received today is worth more than a dollar to be received in the future.

What best describes the time value of money. A dollar today is worth MORE than a dollar tomorrow B. Finding a present value by means of multiplying a future value by a.

Coupon payments are like annuities. The interest rate charged on a loan. Gradual growth of your money due to the interest earned on it B.

Up to 24 cash back What best describes the time value of money. Which of the following best describes the concept of the time value of money. An investment in a checking account.

Present value of Ordinary Annuity payments are made at the end of each period. This is true because money that you have right now can be invested and earn a return thus. A The time value of money has no effect on the timing of capital investments.

View 4jpg from BUS 1323 at Oklahoma City Community College. Changes in interest rates due to changes in the supply and demand for money in our economy. Personal opportunity costs such as time lost on an activity.

The interest rate charged on a loan. 15010 Increased consumer saving and investing is likely to be accompanied by lower interest rates. Group of answer choices Coupon payments are like uneven cash flows.

The interest rate charged on a loan. Bonds and Time Value of Money TVM have some common characteristics. The present value of a future amount of money will be greater the LOWER THE INTEREST RATE YOU MIGHT ALSO LIKE.

Which of the following best describes the concept of the time value of money. If a 10000 investment earns a 7 annual return what should its value be after 6 years. What best describes the time value of money.

An investment in a checking account. An investment in a checking account. This is because of a very important financial concept called the time value of money.

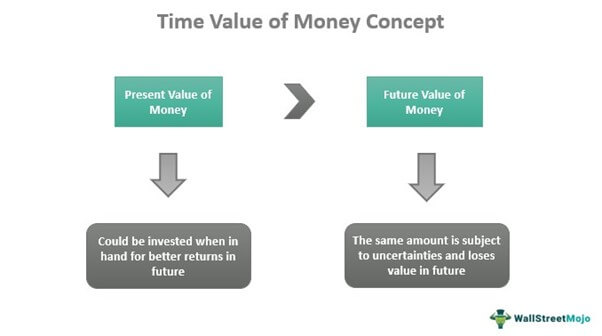

A series equal payments to be received at a common interval during a period of time. The change in interest rates over a period of time OD. The time value of money is a basic financial concept that holds that money in the present is worth more than the same sum of money to be received in the future.

What best describes the time value of money. Financial Management TextbookMediaPremium 1499 STUDY GUIDE Macro Ch. Simple interest is computed on principal and on any interest earned that has not been withdrawn.

The time value of money says that money payments scheduled later in the future are worth less today because of uncertain economic conditions changes in the stock market inflation etc Hence your 10000 today may be more or less than 10000 in the future. Which of the following best describes the concept of the time value of money. Amount principal 1 rate number of compounding number of compounding time When compounded daily the amount 5416388 When compounded monthly the amount 5414998 When compounded quaterly the amount 5412161 When compounded annually the amount 54000 Lowest amount is when the money is.

B Money loses its purchasing power over time through inflation. Interest is the excess cash received or repaid over and above the amount lent or borrowed. Accounts receivable that are determined uncollectible.

4-8 Time Value of Money40 Terms mtmascari Personal Financial stewardship ch. A decrease in the value of money due to environmental factors D. Financial decisions that require borrowing funds from a financial institution.

Increases in an amount of money as a result of interest earned. Up to 256 cash back One hundred dollars today is not necessarily 100 in the future when one invests in an interest-bearing account that grows in value over time. A dollatoday is worth more than a dollar in.

The relationship between time and money. Accounts receivable that are determined uncollectible. Investors are indifferent to receiving a dollar today vs.

The change in net income from one accounting period to another. A dollar today is worth LESS than a dollar tomorrow C. A--the fact that invested cash may not earn interest over time is called the time value of money B--the time value of money has no effect on the timing of capital investments.

2- What is interest. 10132021 Business College answered One opportunity cost families face is the time value of money. The present value of a set of payments.

Accounts receivable that are determined uncollectible. Which of the following describes the time value of money. Neither uses Future Value FV calculations.

Accounts receivable that are determined uncollectible.

Everything You Need To Know About Foreign Exchange Rates Infographic Exchange Rate Foreign Exchange Rate Need To Know

1 How Does The Time Value Of Money Effect The Future Value Of An Investment 2 Why Is It Important To Diversify You Time Value Of Money Take Money Rule Of 72

What Is Crm Customer Relationship Management Explained Customer Relationship Management Relationship Management Customer Retention

Visual Workplace And Lean Manufacturing Lean Manufacturing Process Improvement Key Performance Indicators

An Ideal Elevator Speech Is 30 To 60 Seconds Contains No Jargon Demonstrates The Passion You Feel For Yo Public Speaking Sales Motivation Presentation Skills

Mlops Machine Learning Ops And Why It Matters In Business Fourweekmba Enterprise Application Machine Learning Learning Framework

Are You Bored Living In Poor Mindset You Are On The Right Place If You Want To Learn About Investing In Dividends An Investing Finance Investing Stock Market

Pin By Heng Yi On To Ponder Pinterest Words Quotes And Love Quotes

University Of Phoenix Fin370 Wk3 P2 Aplctn Theory Document Contains 52 Questions And Answers Marketing Definition Theories Nasdaq

Which Of The Following Groups Of Accounts Increase With A Credit In 2022 Accounting Credits Increase

Time Value Of Money Tvm Definition Formula Examples

Undervalued Stocks Dividend Investing Money Management Advice Investing

Money Makes Money And The Money That Money Makes Makes Money But Your Money Will Only Work For You Money Management Advice Business Money Money Management

Types Of Expenses 15 Comprehension Questions What Is Credit 10 Matching Questions Applying Financial Literacy Reading Comprehension Worksheets Financial

Pin By Harold Leonard On Mbti Psychology

/dotdash_Final_Extrinsic_Value_Curve_Apr_2020-01-010f32375f534dd78b2b8af044b8e65d.jpg)

Comments

Post a Comment